The GRM is only useful in providing a rough estimate of value. The Capitalization Rate is a more reliable tool for estimating the value of income producing properties since vacancy amount and operating expenses are included in that calculation. The GRM does not include a property's operating expenses and vacancy rate. Calculating a propertys cap rates is the industry standard for estimating its potential rate of return, and is equivalent to the net operating income (NOI). If our monthly potential gross income is $10,600, we would estimate its value at $869,200.Ī market GRM can provide a rough estimate of value, but it does have some limitations. We can use that data to estimate the value of comparable properties for sale in that market. Since the GRM calculation doesn't include operating expenses, this might not hold true for comparable properties where higher operating expenses may occur.Įstimated Market Value = GRM X Potential Gross IncomeĮxample 2: Let's use Salem, MA for the calendar year 2007. This assumes that operating expenses are proportionate for the properties being compared. When comparing similar properties in the same market, the lower the GRM, the more profitable the property. Most lenders require minimum DSCR of 1.20. Investors and mortgage professionals use the DSCR to measure a property's ability to cover the annual operating expenses and annual mortgage payments. The other ratio the NOI is most relevant in would be the Debt Service Coverage Ratio (DSCR). It is an essential ingredient in the Capitalization Rate (Cap Rate), which is used to estimate the value of income producing properties. NOI equals all revenue from the property minus all necessary operating expenses. It is the NOI, Net Operating Income, of the property divided by the current market value or purchase price. NOI is used in two very important real estate ratios. Capitalization Rate, or Cap Rate, is a calculation tool used to value real estate, mostly commercial and multi-family properties.

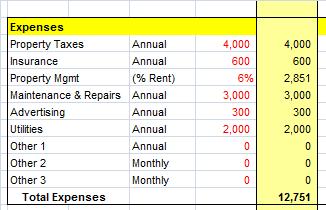

The following are not operating expenses: principal and interest, capital expenditures, depreciation, income taxes, and amortization of loan points. They include all non-interest bearing expenses such as repairs & maintenance, insurance, management fees, utilities, supplies, property taxes, etc. Operating expenses are costs incurred during the operation and maintenance of a property. Basically, any and all income associated with a property. Gross income includes both rental income and other income such as laundry. Understanding Net Operating Income in Commercial Real Estate MaBy Robert Schmidt as published in his blog at Understanding net operating income (NOI) is essential when it comes to investment commercial real estate. Net Operating Income (NOI) is equal to a property's annual gross income, less operating expenses.

0 kommentar(er)

0 kommentar(er)